In this article, we'll provide you with answers to the commonly asked question: how do UK bookies make money? This includes backing and laying, balancing the book, basic odds compilation and overround. We'll also explain how you can use this knowledge to become a more profitable and successful bettor.

- 1 How Do Bookies Make Money?

- 2 Backing & Laying

- 3 Balancing The Book

- 4 The Role of Compilers

- 5 The Bookies Business Model

- 6 Basic Odds Compilation

- 7 Overround, Vig & Juice

- 8 Why do Bookmakers Offer Promotions?

- 9 Should You Bet on Favourites or Outsiders?

- 10 How to Use all this Information to Become a Better Bettor

- 11 ThePuntersPage Final Say

- 12 How Do Bookies Make Money FAQs

How Do Bookies Make Money?

Most people will have heard some version of the phrase “you’ll never meet a poor bookie”. Many people also wonder if bookies always win. While it is difficult to ‘beat the bookies' by consistently making a profit, it can be done.

In order to be successful, it is important to know the mathematics of bookmaking and recognise the techniques bookmakers use to ensure they are always at an advantage.

So, how do bookies make money and how much? How do they stack the betting odds in their favour to make sure that they always stay ahead of the game?

Before we answer any of those questions, there are a number of concepts you must first understand.

Backing & Laying

There are two sides to any bet. Anyone familiar with Exchanges, such as the Betfair Exchange, will have seen the options to ‘back' or ‘lay' any particular outcome on a given event.

For a punter to back their predicted outcome, first they must find someone willing to take the opposing stance i.e. to lay the bet.

Betting Exchanges simply cut out the middleman (the bookie), allowing punters to back and lay directly against each other. The Exchanges earn money by taking a commission on every trade made between punters on its platform.

That gives a brief introduction to the concepts of backing and laying – the two fundamental sides to any bet. In the days before online Exchanges appeared, a traditional bookmaker was the best place to find someone to offer odds on an event – in other words, to lay that particular outcome.

Balancing The Book

The actual term ‘bookmaker‘ simply comes from the practice of laying bets, and more specifically, the recording of these bets in a ledger or book, hence ‘making a book’.

When making a book, the bookie is simply laying each possible outcome of any given event in such a way that will guarantee them a profit no matter the outcome.

But how do they do that?

In very simple terms, the bookmaker achieves this by setting appropriate odds for every possible outcome and taking an appropriate amount of money on each outcome.

It’s worth pointing out though that this is more complicated than it can initially appear, because bookmakers are not working in a vacuum. They also have to consider and adapt their odds based on the fluctuations in the market.

The reasons for this are simple: if they present odds that are wildly different to another operator, that makes the market uneven because you end up with one bookmaker offering distinctly better odds in one market, and much worse odds on another. This can be taken advantage of by savvy punters, who could utilise this difference in odds to ensure that they have a mathematical edge.

For this reason, you generally don’t have huge differences in odds across major bookmakers, and in this way, they work to balance each other out. It’s also part of the reason why a smart bookmaker would never offer anything other than fair odds to its customers, alongside the fact that you could simply switch to a better offer.

Another thing to take into account is that the way in which people bet also has an impact on the odds. Bookmakers are, just like their customers, always trying to work out how much they can afford to lose on one market. Therefore, their odds and the book balance are impacted by how many people bet on a market. A lot of bets on one side could drive those odds down, for instance.

If all this sounds incredibly complicated, well, it is. These days, bookmakers have sophisticated technology to do all of this automatically for them. However, the underlying principles remain the same as they always have been, and that is to ensure a balanced book where and how bookies make money no matter the outcome.

The Role of Compilers

While fluctuations in the market and the shifting odds of other bookmakers are now dealt with by lightning fast computers, at the end of the day, bookmakers and betting all comes down to making predictions on sporting events. And things like who you think will score first, or which team will win, for instance, isn’t something you need anything other than some tactics to have a smart and logical opinion on.

Let us introduce you to the compilers. These are the people that you are essentially up against. They are the people setting the odds and the ones who you are trying to out-predict.

Remember that one of the key concepts behind smart betting is to recognise when you think a bookmaker, or the compiler, has made a mistake. There are people, not machines, behind this at the end of the day, and we all know that there is more to sports than what you can get from the stats sheets, as useful as they can be.

When you are looking at different bets, ask yourself whether you think their prediction is accurate based on the games you’ve seen, and everything else you have taken into account during your research. Make no mistake, the compilers are experts at what they do, and they best know how to utilise data just as well as they understand the intricacies of the game.

The reason we bring them up is that it is vital to understand not only how bookmakers make money, but also that it is people making predictions (admittedly with the aid of computers and spreadsheets). These same people can make mistakes, and smart betting is simply about spotting them. With that in mind, let’s move onto the maths.

The Bookies Business Model

To begin to understand the bookies’ business model, we first have to have a basic grasp of odds, how they’re set, and how they relate to the true probability of each outcome actually happening.

In a previous article where we explain the Gambler’s Fallacy, the example used to illustrate this was a coin toss. The coin toss will once again come in handy here, so let's recap.

A coin toss has two possible outcomes – heads or tails. Each has an equal 50/50 chance of landing. This would be reflected in ‘true’ odds of Evens (2.00) for each outcome. When laying both outcomes at those odds, in order to balance their ledger, any bookie would have to take an equal amount of money on each outcome – let’s say £50 on each.

If heads, the bookie pays out £50 to the winning heads backer. However, this would be offset by the £50 the bookie makes by keeping the losing tails backer’s stake.

Breaking even like this would be, by definition, a pointless exercise for the bookie though, whose raison d’etre is to make a profit.

That brings us to the crux of this article: how do bookies make money and ensure they always remain profitable?

Basic Odds Compilation

Let's go back to the coin toss and consider how and why bookies arrive at the odds they do when laying such a bet.

Before anyone argues that you can’t place a bet on the toss of a coin – you can! Below is an illustration of how (from England's third group game at the 2018 Cricket World Cup).

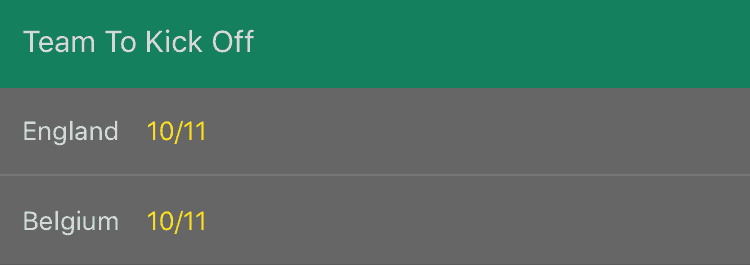

Here, the bookie (bet365) is offering odds on which team will kick off. How do we determine who kicks off? With a coin toss!

So for our purposes we shall say England is heads and Belgium tails.

The first thing you’ll notice are the odds. In this case they’re not Evens (2.00) which would be the true odds of either outcome. Instead odds of 10/11 (1.91) are being offered.

The question is, why the difference and what does it mean to us, the punter?

To answer that we have to look at the implied probability these odds indicate. 10/11 (1.91) gives an implied probability of 52.38%. Add together the probability of both outcomes and you get 104.76%.

The true odds of Evens (50%) would give a ‘perfect’ book on this market of 100%. However, as we discussed earlier, the break-even point of 100% is no good for a bookie to be profitable.

Slightly overestimating the probability of both heads and tails (in this case by 2.38% each) gives the bookie a profit margin of 4.76%. This means that if the bookie takes £50 on each outcome to balance its ledger, the payout on the winning bet will be 1.91 x £50 = £95.50.

Remember, the bookie has taken a total of £100 worth of stakes on the two outcomes and will pay out just £95.50 to the winner, no matter the result. In this way the bookie guarantees a profit of £4.50 on either outcome.

That is a very simple example with two possible outcomes. In football, even on a basic 1X2 market, there are 3 possible outcomes. In a horse race there could be as many possible outcomes as there are runners.

Overround, Vig & Juice

The same principle applies no matter how many outcomes are under consideration though. The important thing for the bookie is that adding the implied probability of the odds of each outcome gives a total figure higher than 100%.

Anything over 100% is the bookies’ profit. This is known as the bookies’ overround or the house edge. In America, it is known as vigorish (shortened to vig). It can also be colloquially known as ‘juice’ or a myriad of other terms. However, all are just shorthand to describe the bookies’ profit margin.

Win/Draw/Win

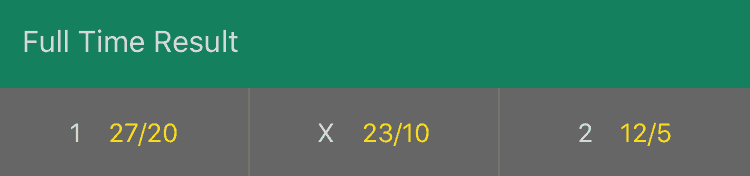

Now let’s take a look at a 1X2 market on a football match to expand on how the bookie applies an overround.

In this example, with odds quoted as a fraction, it’s easy to convert them into decimal odds to see the implied probabilities (if you're struggling, you can use our odds converter calculator).

-

1 (Home Win): 27/20 (fractional odds) = 2.35 (decimal odds) = 42.55% (implied probability)

-

X (Draw): 23/10 = 3.30 = 30.30%

-

2 (Away Win): 23/10 = 3.40 = 29.41%

Adding the implied probability of all three possible outcomes (42.55 + 30.3 + 29.41) comes to 102.26%. This gives an overround of 2.26% thus guaranteeing the bookie a profit no matter the outcome.

That 2.26% may not seem like much, but consider that this is 2.26% on every single bet, everywhere. With the millions of pounds staked on hundreds of thousands of events every single day, you can see how this would soon mount up.

Compounding

Maybe unsurprisingly, bookies aren't happy to settle for just a 2.26% profit margin. So they have a few more tricks up their sleeves. Offering multiple selections is the most obvious and most common. So doubles, trebles and accumulators come into the equation.

If you calculate the overround on each selection, you will be able to decide whether you have a ‘value’ bet based on your own estimations of the market.

From the example above, you make your selection from the 1X2 options with a market overround of 2.26%. Add in a second selection to make a double and what happens? (We’ll keep the odds the same for simplicity). So, the bookie has another 2.26% overround or profit margin giving a total overround of 2.26 + 2.26 = 5.52%, thus compounding their profit margin.

On 3 selections (with the same odds), that becomes 2.26 + 2.26 +2.26 = 7.78%. This continues to compound as you add selections to your accumulator. So not only are the odds of your bet landing getting longer, the bookies’ profit margin keeps getting higher and higher as well.

Having said all this, you shouldn’t let it put you off – accumulators still have their advantages. You may get a higher overround but on the other hand, you also get the chance to win huge amounts of money for an incredibly small stake. Also, keep in mind that it’s because the accumulators are so favoured by bookmakers that you often get incredibly generous promotions on them.

On top of that, remember that betting should always be about improving your enjoyment of a sport. One of the things we really love about accumulators isn’t anything tactical: it is simply that it’s a great way of providing investment in games and especially in long tournaments. It can provide a thread that makes even the most average looking games interesting.

Ultimately, if you put a fiver on an accumulator bet that kept you invested in several games when you would otherwise have been less interested, and you lose, we would still consider that money well spent, even if that might not take the sting out of the loss.

Why do Bookmakers Offer Promotions?

One of the most common things we are asked in relation to how bookmakers make money is why would they offer promotions. Or, let us put it this way, why would a bookmaker offer a legitimately generous promotion if their aim is to make money? This question is usually from people who are sceptical of bonuses and promotions in general, and simply can’t see how they could actually provide value without some sneaky terms and conditions making it actually far from worth your while.

Before we go any further, we want to preface this by saying we are absolutely aware that some promotions are indeed wolves in sheep’s clothing, with poor value and titles that are deliberately misleading. That is why we go through all the terms and condition of every promotion we look at in incredible detail to make sure that is not the case before we give any recommendations.

With that said, there is no reason to be generally sceptical. Bookmakers have one very good reason to be generous with their promotions, and that is competition. They are willing to potentially lose a small amount of money on a free bet, for example, because the sheer amount of competition out there means that they cannot be secure in getting and maintaining users, which is the lifeblood of their business and the source of their money, if the customer chooses somewhere else.

There are so many operators out there that good promotions are considered to be an investment in what they hope will be the retention of a long term and loyal customer because they are happy with the product that they’ve been provided.

Should You Bet on Favourites or Outsiders?

Remember before when we were discussing how market fluctuations have an effect the need for balancing the market? Well, this can make favourites or outsiders objectively better or worse than another in terms of the quality of the odds. One really clear example of this is when the favourites get a huge amount of support. In order to avoid losing a lot of money if the favourites win, the market may need to discourage further betting by lowering these odds, essentially providing an artificially ungenerous predication.

Often, you can also get very good long shot bets because there’s so little support for them. The absolutely astronomical odds for Leicester City winning the Premier League remains perhaps the clearest example of this. Usually, when there are these kinds of fluctuations, it favours the outsiders, whether it be with excellent long odds, or ungenerous short odds.

With that said, we do think that this is something to consider rather than basing your whole betting tactics around. Simply look for where you disagree with the prediction presented and where you think you are getting a good deal on odds, whatever they may be. However, we think that maybe it is worth looking out for outsider bets that seem especially generous a touch more.

How to Use all this Information to Become a Better Bettor

To outsiders, bookmakers often have this mysterious edge to them which makes them seem like their business and their odds are somehow protected by forces and intelligence beyond our understanding. Breaking down how they work can make them seem much like intimidating.

Ultimately though, what we want this information for is to use it to our advantage. Taking into account all of the things we now know about bookmakers; we are going to break down what we think are five of the most important pieces of advice to utilising this information to make smarter bets.

1. Choose Good Bookmakers

When you see how these businesses work, one of the things that become obvious is that while bookmaking can be a very profitable business, maintaining success in itself is an incredibly complicated and difficult undertaking. This is especially the case when you combine this complexity with the amount of competition that is out there.

The best bookmakers understand that the way to make money is through having a large customer base and the only way to do that, considering the amount of alternative options that are out there, is by keeping customers as happy as possible. This means the best possible odds, promotions, customer service, quality, variety: the works. The single best thing you can do to start betting on the right foot is to pick a quality bookmaker.

2. Use the Overround to Test the Quality of the Market

We discussed the overround earlier and it really is one of the best, most sure-fire ways of getting to grips with the quality of that betting market in general. Add up all the possibilities, convert them to percentages and see what the result is. The closer to 100%, the better. With good margins generally you can then start to break down what are your best betting options based on those odds.

3. Make the Most of Promotions

We really hope that one of the things we have made clear in this article is that not only does good bookmakers offering great value promotions make sense, it’s also actually a smart long-term business practise. This means there’s absolutely no reason for you to be sceptical of bonuses in general, because much of that scepticism comes from people being unsure how this fits logically into a for-profit company. As we’ve explained, the answer to that is simple: competition and your value as a customer.

So, be vigilant about ensuring you are getting value out of your promotions. Check out our recommendations, for instance, but do take advantage of them as they can lead to a more positive and profitable betting experience.

4. Pick a Technologically Sound Site

This, in particular, is one for you live bettors out there. We have talked about the fluctuations in markets and how understanding these is key to not only how betting sites make money, but also how you can bet smarter too. There is no circumstance where this is more vital than during live betting, especially during a game with plenty of twists and turns.

A technologically sound, fast updating site is the only way of reacting as quickly as you can and betting as effectively as you can in this scenario. So, when picking a bookmaker, don’t count out the importance of the live experience.

5. Utilise Different Markets

We have said that smart betting is all about finding areas where you disagree with the bookmaker on the likelihood of an outcome. It is your wits against theirs, but they don’t make too many mistakes. Branching out into different markets simply provides you with more opportunities to spot great value odds and where you think you can best place your money. Betting is a numbers game, in more ways than one.

ThePuntersPage Final Say

The concepts of backing and laying, odds compilation, implied probability, and over-round or vig are the fundamental building blocks that the bookies rely on to ensure that their profit is guaranteed, no matter the result. However, this should not be viewed as a negative.

Ultimately, we want bookmakers to stay in business and so should everyone who uses them, because without those advantages your betting opportunities would be far scarcer. Those advantages, like the overround, are like a price of admission: it’s the reality of being able to bet on so many different things and get real winnings as a result.

Also, just because bookmakers have to win more than they lose, that doesn’t mean that the result in terms of your bets are set in stone. Other people do win, and by making sure you pick good bookmakers and follow smart practices, you can greatly increase your chances of being amongst them. You can easily grasp the concept of betting online by reading our article on How to Bet Online.

How Do Bookies Make Money FAQs

Put as simply as possible, bookmakers make money from people placing and losing bets. All other complications and how much goes into them winning consistently enough to make this profitable aside, that is the foundation of this business.

No, bookmakers give out fortunes in losses every day. It’s just that they win more than they lose. If you make a prediction and that prediction comes true, you will win money. It’s as simple as that.

You may be wondering then, how bookmakers consistently make money. Well, that’s partly down to something called the overround. This is the amount above 100% all of the possible outcomes come to. It is essentially the edge they have over the player in terms of odds. This is something you do need to contend with, but it is simply needed to help bookmakers stay in business. And the overround should never be excessive, a few percentages above 100%. Generally, below 110% is what you would expect.

No, if you think the favourite is going to win, especially if you think they are still underrated despite being favourites, then backing them is still the smart choice. The reason people say this is because often favourites get lower odds than they should do, due to a lot of people backing them. But this is all on a case by case basis. You can still get good odds on favourites.

It is a common misunderstanding that because bookmakers are trying to make money, they therefore won’t actually offer real value in their promotions. However, this is short-sighted. Bookmakers need people to bet using their site over all the others out there in order to stay in business, and many of them view promotions as a small price to pay to get people through their virtual doors. To put it simply, promotions truly can offer real value.